Anyone who has purchased a big ticket item probably has had to converse with a representative from the bank or credit union. Big ticket items include but are not limited to residential homes, cars, farming equipment and the list goes on. The main emphasis on the approval of your loan was in large part based on what percentage your debt to income ratio turned out to be.

Understanding debt to income ratio

Keeping debt under control and within limits is the key indicator for the bank to identify that will determine whether or not you will receive a loan. Lenders use this ratio that is compiled from all the income that you receive against all the debt that is presently owed and compute a percentage. This percentage factor is crucial in giving approval to a loan.

This ratio percentage is not a magical number. It is derived from absolutes that you can determine yourself. This is not a complicated process but it does need to be approached in an organized manner. Fortunately there is an easy to determine your credit feasibility through the use of excel templates.

Benefits of an Excel template

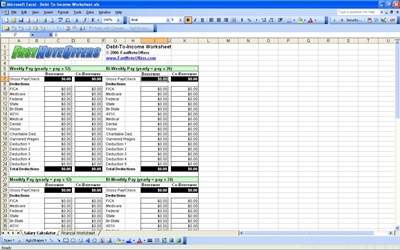

There is a website that allows anyone to access excel templates that can determine your debt to income ratio absolutely free. These templates have been created in support of people who want to determine how much actual income versus how much debt they currently have.

These Microsoft Excel templates break down every single financial item that needs to be identified. This may seem painful at first, but knowing this information before going to a lender will help determine whether or not a loan is likely to be approved.

Spending a day analyzing your financial status can go a long ways in planning out the future. If the percentage of this crucial ratio is too high, then the reason is that there is too much debt. Paying off debt is the best recourse at this point.

Related Templates:

- Debt-to-Income (DTI) Ratio Calculator

- Debt to Income Calculator

- Debt Snowball Calculator

- Income Statement

- Deposit Ticket Template

View this offer while you wait!