If you are planning to apply for a loan for any reason, whether it is for a mortgage or the kid’s school fees, or to buy the new car you have been promising yourself, you will need to check and accurately calculate on your debt to income ratio with this template.

The ideal solution for this is the excel debt to income ratio calculator; this would be a wise choice to enable you to know your financial health and plan for your future.

If you are thinking there must be an easier way to figure out your financial debt ratio without causing you any further confusion, which could have been contributing to a delay of your account payments. Having this debt to income ratio calculator could really make a big impact on your decisions and help you with your everyday living.

Debt to income ratio assessment

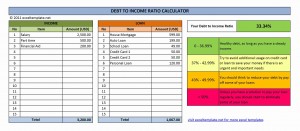

To make a start in order for you to calculate the debt to income ratio, you have to fill in all your income and then list all your debts, however large or however small they may be, into this easy excel template that illustrates the income, loan and the debt to income ratio.

This debt to income ratio calculator could give you a complete picture of your entire debt to income ratio; this would then help you to assess the entire percentage of the loan that you need to take into account.

You must also be able to input your entire income to re assess and evaluate your debt to income ratio, in regards to your financial health and aid.

You should also keep in mind the need to add in any additional debts that you incur do not have to pay every month.

Reduce some debts to pay off loans

This debt to income ratio calculator is easy to use for you to calculate your financial position. You just have to fill in the necessary information regarding your loan, may it be for a mortgage, house loans, school loans, credit cards or other personal loans that you are committed to.

You also have to take into consideration your estimated salary; including any part time salary, over time or bonuses, if there are any, and the financial aid that is needed.

Upon the filling of all this necessary information, the debt to income ratio can now be calculated in terms of percentages. Wherein a complete list of percentages can be calculated using your debt to income ratio calculator.

The percentage could help you identify and evaluate whether there is no problem in your payment, there is a need to avoid additional usage, a need to reduce some debts or pay off loans to take advantage of the situation of that particular lone, or an urgent need to eliminate some loans all together.

A solution for your loan inquiries

The debt to income ratio calculator is a really helpful tool to assess and figure out the best solution for your loan inquiries and deals. With your existing loans you can calculate which loans are costing you the most in interest and then you will be able to concentrate on repaying them first.

Download Debt to Income Ratio Calculator

Related Templates:

- Loan Payoff Calculator Excel

- Debt to Income Ratio

- Debt to Income Calculator

- Debt Snowball Calculator

- Debt Repayment Calculator

View this offer while you wait!