Snowballing credit card debt means to pay off one debt at a time with all of your available cash until the debt is fully paid off, then move onto the next debt and repeat. All other credit cards or debts are paid at their minimum rate until it is their turn to be snowballed. This concept is known as a debt snowball plan and is often simplified by the use of a debt snowball calculator or a debt payoff calculator. You can download this snowball calculator here.

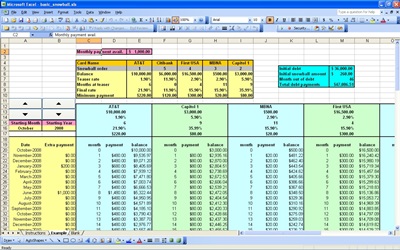

Knowing where to start on your debt snowball plan makes all the difference. Use a debt snowball calculator to help you prioritize your debts and keep track of your progress. With this snowball debt calculator spreadsheet, you can enter the rates (including teaser rates) and balances of all your debts, as well as change the order of your debt snowball plan to assess the best payoff times and least cumulative expenses. At the top of the snowball debt calculator spreadsheet, you will see an overview area to input each debt, their ‘snowball order’ and your overall initial debt and initial snowball amount. You can also view your total debt payments with the debt snowball calculator. The snowball calculator will automatically adjust values within the worksheet.

This is a detailed snowball debt calculator spreadsheet that is designed to help you with your debt snowball plan. Using a debt snowball calculator will help you become debt free over time. This free Excel template has a built in snowball calculator with examples already built into the worksheet to show you how to use the snowball calculator to manage your debts. The snowball calculator is free to download. See the link below to begin using this snowball calculator in Excel. Other useful Excel calculator templates are also available on our website.

What is a Debt Snowball Calculator?

This is a template that you can use if you want to pay off one credit card at a time. You will use the debt snowball calculator to set up each credit card account, and then you will list each payment made to that account until the card is completely paid for. The calculator can help you determine which card you need to pay off first and which ones you can make the minimum payment on.

Who Can Benefit From a Debt Snowball Calculator?

This tool can help those who have several credit cards and do not know how to get their budget under control.

Related Templates:

- Credit Card Payoff Calculator

- Loan Payoff Calculator Excel

- Credit Card Payoff Calculator

- Debt Repayment Calculator

- Debt Reduction Calculator

View this offer while you wait!