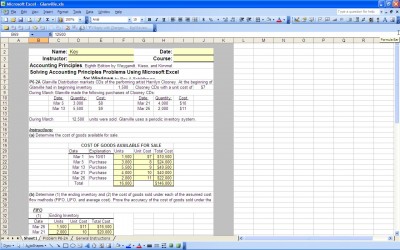

In the income statement for a business one of the key figures is the cost of goods sold (COGS). This figure tells anyone reviewing the financial statements how much it cost for the business to provide the goods and services it sells to customers. There are different formulas used to determine cost of inventory depending on the inventory method and assumptions used. The excel template can be used to calculate COGS by plugging the appropriate figures into the formulas built into the template.

Perpetual Inventory Method

This method is used to track each unit of inventory minute by minute through the business. This method is the most expensive, but also the most accurate. Using this method it is possible to track inventory shrinkage (theft or damage), whereas with the periodic inventory method shrinkage is either not tracked or is estimated based on reconciliations of purchases and sales and past experience.

Periodic Inventory Method

This method is used when an inventory count is taken periodically, usually once a year. The ending inventory is determined from the count. The ending inventory becomes the beginning inventory for the next period. Knowing the beginning inventory, purchases during the period and ending inventory, the cost of goods sold can be easily determined.

First In First Out Assumption

When using the perpetual inventory method each inventory piece is tracked and can be matched to an sales or shrinkage. When the periodic inventory method is used certain assumptions are needed to measure cost of goods sold. The first in first out assumption or FIFO assumes that the first inventory items purchase were the first ones sold. The cost of the first inventory items is matched to the inventory used up or sold.

Last In first Out Assumption

The Last in first out assumption or LIFO assumes that the last inventory items purchased were the first ones sold. The cost of the last inventory items purchased is matched to the inventory used or sold. At least in theory the last inventory purchased has a higher cost than the first inventory purchased, so the assumption used is going to make a difference in the cost of inventory and the gross profit margin.

Average Cost Assumption

The average cost assumption involves calculating the average cost of inventory per unit and assuming that each unit of inventory cost the same price (the average cost calculated).

The FIFO assumption may inflate income for the period by understating actual inventory cost, LIFO may lower income for the period by over stating inventory cost and average cost assumption should smooth out inventory cost over the period.

But since consistency in accounting methods is required by generally accepted accounting principles (GAAP) a business cannot switch back and forth between inventory methods and assumptions, so in the long run the method and assumption used will even out and give a fairly accurate measure of inventory. Using the excel template makes the calculations easy to do each period.

Related Templates:

View this offer while you wait!

thanks for this TEMPLATES

Thank you.