Every business is responsible for some form of tax liability (total amount of tax that an entity is legally obligated to pay to an authority as the result a taxable event). This could be anything from your annual income to selling an asset. Now you can make your life easier by monitoring or storing your tax liable property or events in this simple document. The Estimate of Tax Liability template makes storing this information simple and quick. Just download the template below and follow the direction to create your very own Tax Liability template.

How to Use the Estimate of Tax Liability

Download the free template by following the link located at the bottom of this page.

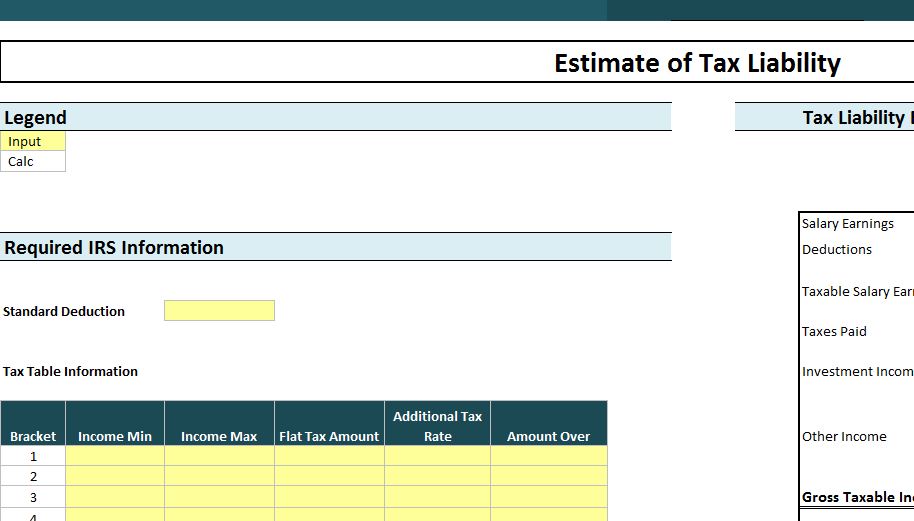

First, familiarize yourself with the structure of the template and the legend at the top of the page. You will see that all the information required to complete the template will be entered in the sections highlighted in yellow.

The white cells will simply calculate totals for you so you can simply ignore these as you move through the list. There is also another sample tab that shows you what the document looks like once it has been completely filled out.

Enter your standard deduction number at the top of the screen and continue to fill out the “Tax Table Information” chart below.

Once you have filled out all the sections highlighted in yellow you will be able to receive all the calculations from the information you entered throughout the document. You can view the “Total Overpayment/ (Underpayment), Additional Required Payment to IRS to Pay 90% of Tax Liability, and much more.

Now, you never have to live in fear of tax season again, download the free Tax Liability template to calculate your tax information today.

Why You Should Use the Estimate of Tax Liability

- Comes with an example page to help you with formatting

- Areas that need focus are highlighted for you

- Everything you need is on one page

Download: Estimate of Tax Liability

Related Templates:

- Corporate Tax Calculator

- Job Estimate Template

- Printable Job Estimate Sheet

- Financial Freedom Calculator

- Checklist for Tax Deductions

View this offer while you wait!