The Corporate Tax Calculator can help you and your business calculate the amount you’ll owe at the end of the year with only a few pieces of information. The document works as a simple Excel spreadsheet that contains tables with the information required by most tax forms from the government. You will go through and enter your specific tax information for your business so far and the template will calculate the tax on your business’s income. It’s simple and free to use so you have nothing to lose just follow the link at the bottom of the page to get started.

How to Use the Corporate Tax Calculator

Start by entering the name of your company or business in the indicated area at the top of the “Business Structure” tab. You can add or edit information in a cell simply by clicking on it and writing something.

In column B, the template has listed questions that span the entire length of the page. Areas highlighted din dark gray will not be touched as they provide you with calculations. Every other area is where you will enter your own information based on the corresponding question from column B.

You will enter information such as your estimated tax liability, salary from business, FICA withheld from salary, etc. By the end of the template, the document will calculate the amount you owe in taxes for both you and your business.

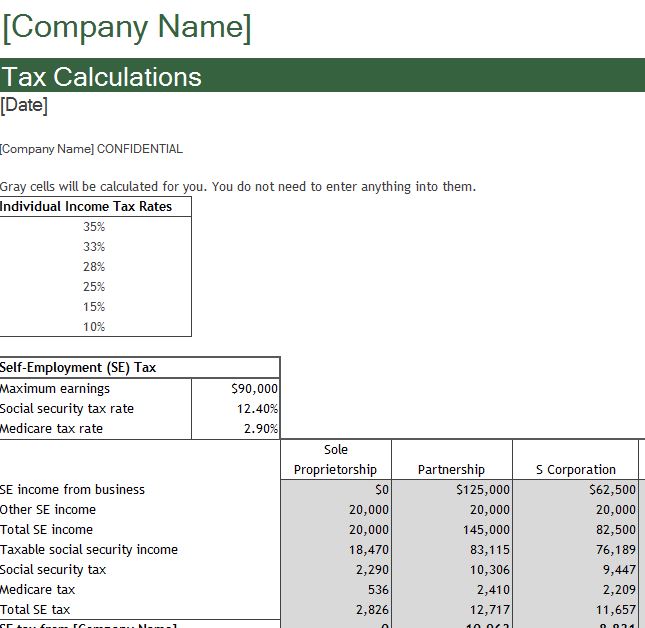

There is also a “Tax Calculations” tab at the bottom of your screen. If you click on it, you will be taken to a new page in which you can calculate a more comprehensive breakdown of your taxes alone. This will help give your perspective on why you owe so much or so little this year.

You have all the information, expertise, and experience to file your taxes correctly this year, this template simply gives you an easy way to store all this information on a single page.

Download: Corporate Tax Calculator

Related Templates:

- Tax Savings Calculator

- Tax Forms W-2 Sheet

- Area & Perimeter Calculator

- 2012 Tax Calculator

- Hourly Wage Calculator

View this offer while you wait!