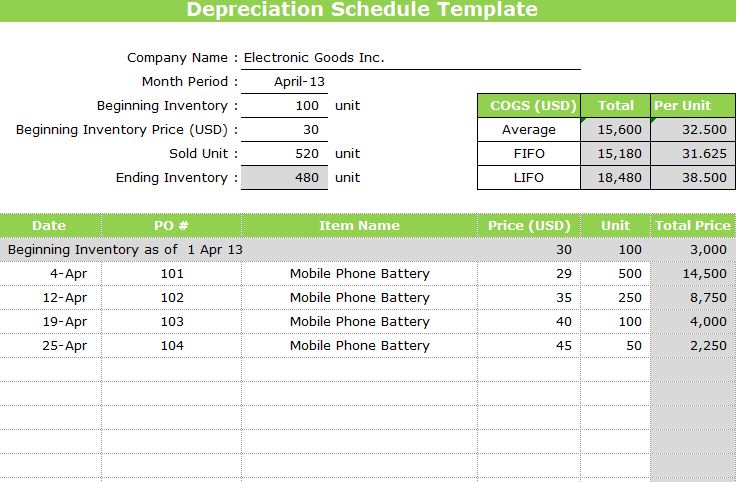

For business owners, being able to track the depreciation of their capitol assents is important to remaining up-to-date on the business’ financial value. One of easiest ways to track your business assets is to use the depreciation schedule template in Microsoft Excel.

By using the depreciation schedule template, business owners can track their assets as well as the corresponding depreciation through the year within a simple and easy to use spreadsheet. With the deprecation template, tracking asset depreciation and value is made much easier. The depreciation schedule template is free to download, easy to use and completely customizable.

With this depreciation schedule template, businesses are able to create asset specific columns based on whatever criteria that is deemed necessary for tracking and recording the assets. Whatever columns a business owner or financial officer wishes to make can easily be done with this free template. Once downloaded, the template allows even the most inexperienced business owner to track their assets as simply and easily as possible.

Using the Depreciation Schedule Template

When first using the template, it is important for a business owner to take the time to label specific columns for each specific asset. Labeling each asset correctly is important to avoid confusion, therefore it should be done immediately.

To use the columns already setup within the template, simply click the example text and type over it with whatever text you desire. Columns can easily be added and subtracted by right clicking whatever column desired and selecting add or delete within the drop down menu. The template allows for as many or as few columns as a business owner deems necessary.

Once the columns are setup according to the specific needs of your business, you can fill in the values of each asset as needed. To add or subtract text within a particular cell, simply double click the desired cell and begin typing the values and depreciation amounts needed for your business.

Finally, once the template is setup as you like it, you can begin adding all your assets as well as their purchase price and value, their current estimated value and finally the retired value of the assets should the business decide to permanently retire or salvage that asset. Additionally, if you choose to, you can also add the value in years the asset has left. This feature is specifically useful for cars and other such assets that depreciate heavily with each passing year.

The depreciation schedule template is an effective and easy way to help business owners keep a working long term depreciation schedule for their assets. The spreadsheet should be updated after an asset is acquired, sold or retired to ensure accurate record keeping within the spreadsheet.

Download: Depreciation Schedule Template

Related Templates:

- Depreciation Calculator

- Home Inventory Spreadsheet

- Equipment Inventory Template

- Opening Day Spreadsheet

- Medication Schedule

View this offer while you wait!

thanks