Everyone knows that doing taxes can be an absolute nightmare. Most people would rather save themselves some money rather than pay someone else to do their taxes for them. These people need as many helpful tools at their disposal as they can get. A 2012 tax calculator is designed to save you both time and money. Perhaps the best thing about this income tax calculator is it is instantly downloadable and completely free, saving you time and money immediately.

Using the 2012 Tax Calculator

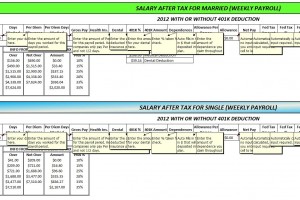

The income tax calculator available on this site could be exactly what the doctor ordered for your tax problems. There are sections dedicated for every type of deduction and expense imaginable. First, you must choose which calculator is right for you. The top calculator is for those who are married, while the bottom was created for those who are single. They are separated by color-coded bars.

Once the appropriate calculator has been selected, you will enter your salary in the corresponding box. In order for the calculator to work, you will have to manually input the information for several categories, including Days Worked, Per Diem Allowance, Per Diem Worked, Gross Pay, Health Insurance, Dental Insurance, Dental Insurance, 401K %, 401K Amount, Dependences, Allowance Per Person.

The calculator will not working without inputting the above information. It’s critical to properly input the information in order to get accurate numbers and calculations. It’s encouraged to carefully review all the information before it is entered into the calculator.

There are several categories that will be automatically calculated once this information has been input, including:

- Net Pay

- Federal Tax Amount

- Federal Tax %

- Federal Tax % Amount

- Total Federal Tax

- Social Security

- Medicare

- Salary After Deductions

- Per Diem

- Take Home Pay

The tables below the respective calculators are the percentage method tables for income tax withholding. While similar in appearance, the financial figures for singles are married couples are very different, so please review them carefully. The percentages and financial figures are only for wages earned in 2012.

Download: 2012 Tax Calculator

Related Templates:

- Federal Tax Calculator 2012

- Excel Payroll Calculator

- Detailed Budget Planner

- Payroll Calculator

- Australian Tax Calculator

View this offer while you wait!