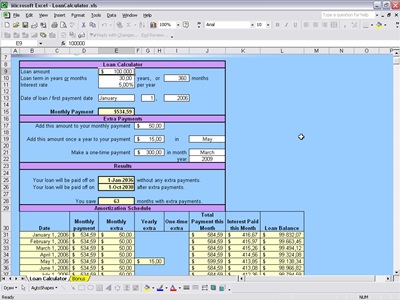

Are you interested in a loan? Are you searching online for best offers available at the lowest interest and favorable terms? Before making the most important decision of your life, you should use free loan calculator available online because it will help you in comparing different loans, so you can choose the best one for your needs. Using a free Excel template, you can try different combinations to see which option will be suitable for your needs. Using the loan calculator, you can calculate your monthly payments based on these parameters: the loan amount, term, and length of the loan.

How to Use a Loan Calculator

There is nothing too complicated about this calculator. You just have to enter the loan amount that you want to borrow in the designated column. Next, you should enter the interest rate that you will have to pay. Then enter the duration of the loan. Keep in mind that longer the term of the loan, the higher would be the interest that you will have to pay during its entire term.

Once you’ve keyed in the information, you just have to click the calculate button to estimate the principal and installments that you will have to pay every month. If you want, you can easily manipulate the loan amount and the loan term to come up with an affordable repayment amount. Once you’ve filled all the fields with the appropriate information, you will get the results within few seconds once you click the compute button.

You can also use this loan calculator for computing amount you can borrow, debt consolidation and your tax savings. For computing the loan amount you can borrow against the equity in your house, you can to answer few questions, such as places where you will use the money, loan amount and terms of the loan. However, you must understand that there are additional costs involved when acquiring a loan.

Related Templates:

- Auto Loan Calculator

- Car Loan Calculator

- Excel Loan Calculator

- Home Loan Calculator Excel

- Loan Analysis Worksheet

View this offer while you wait!