Although it’s a common necessity for any individual or family looking to save money, you’d be surprised how often budgeting gets overlooked.

Although it’s a common necessity for any individual or family looking to save money, you’d be surprised how often budgeting gets overlooked.

According to the 2012 Consumer Financial Literacy Survey from the National Foundation for Credit Counseling (NFCC), nearly 56 percent of Americans have omitted making a personal budget in their finance plans.

Not surprisingly so, this study parallels a jarring increase in typical household credit card debt, with the majority of Americans saddled with nearly $15,000 in the negative.

Budgeting is arguably one of the most crucial aspects to both saving – and wisely spending – your cash. But more often than not, a budgeting venture has the tendency to lose steam a few weeks down the road. Unless you take the time to properly plan your financial stream, and from an organized vehicle, it’s likely you’ll financially fall.

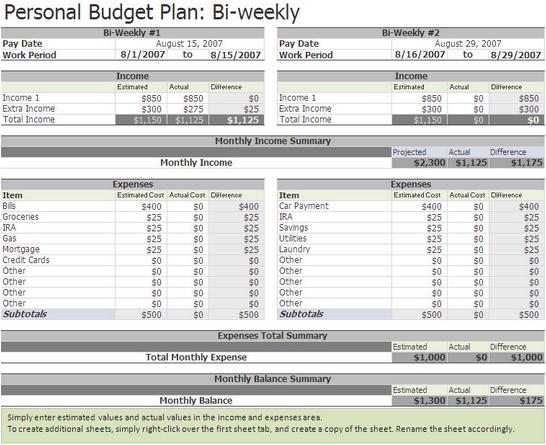

But with the Biweekly Budget Excel Template from ExcelTemplate.com, that budgeting process can be contained and mapped with a single simple, easy-to-navigate vehicle.

How the Biweekly Budget Excel Template Can Organize Your Finances

With the Biweekly Budget Excel Template, users can effectively:

- Keep stringent track of all facets of your finances. This includes payday, your individual work period, utility bills, groceries, IRA and credit card/mortgage bills.

- Strategize your future financial moves. The Biweekly Budget Excel Template allows you to analyze your current financial portfolio from an overarching perspective. And with this information, you can effective map and strategize new ways to conserve cash.

- Keep track of your overall monetary input and output. The Biweekly Budget Excel Template grants users the ability to gage their bi-weekly financial stream from an overarching perspective, giving glimpse to a grander financial picture.

- The key to effective bi-weekly budgeting is thoroughness and honesty. Be sure to include every little minute expense, as insignificant as it might seem—those Starbucks lattes and theater runs can add up.

- Once you’ve outlined your complete expense list, look for unique ways to trim it down. Cutting back on costs like cable, expensive foods and alcohol can dramatically lift financial holes.

Tips for Forming an Effective Personal Budget

- The key to effective bi-weekly budgeting is thoroughness and honesty. Be sure to include every little minute expense, as insignificant as it might seem—those Starbucks lattes and theater runs can add up.

- Once you’ve outlined your complete expense list, look for unique ways to trim it down. Cutting back on costs like cable, expensive foods and alcohol can dramatically lift financial holes.

Download: Biweekly Budget Excel Template

Related Templates:

- Credit Card Payment Calculator

- Monthly Cash Flow Plan

- Financial Profile

- Home Budget Calculator Excel Template

- Family Budget Template

View this offer while you wait!