Piles of scattered paperwork. A flurry of confusing financial terms. A looming – and increasingly daunting – deadline. Overwhelming feelings of constraint and stress.

Ah, the sour smell of tax return season 2013 is in the air.

For most working Americans, the manic months leading up to April can be suffocating. Every day, dozens of irritatingly chippy billboard, radio and television ads serve as constant reminders that “D-Day”, or “deadline day”, is fast approaching. And although a hefty tax return is looming for a large majority of us after the filing deadline, reaching that cash pile can seem like scaling Mount Everest with no oxygen.

The average American taxpayer will spend an estimated 23 hours completing and filing their 2012 taxes this year. And although 80 percent of taxpayers will typically hire outside help to assist them, a sizable bulk of basic filing duties tend to fall back on the individual consumer.

But one of the most persistent reasons we tend to feel time-strapped during tax season is, not surprisingly, our failure to prepare. When the time finally comes where we’re required to put pen to paper, a great deal of Americans are somewhat confused where they stand from an economic standpoint.

Unfortunately, this failure to prepare can have costly results for consumers in the long-run, from missed tax deductions to overlooked opportunities. However, one of the quickest, and most time-efficient ways to complete your taxes frill- and frustration-free is to use a tax return calculator 2012.

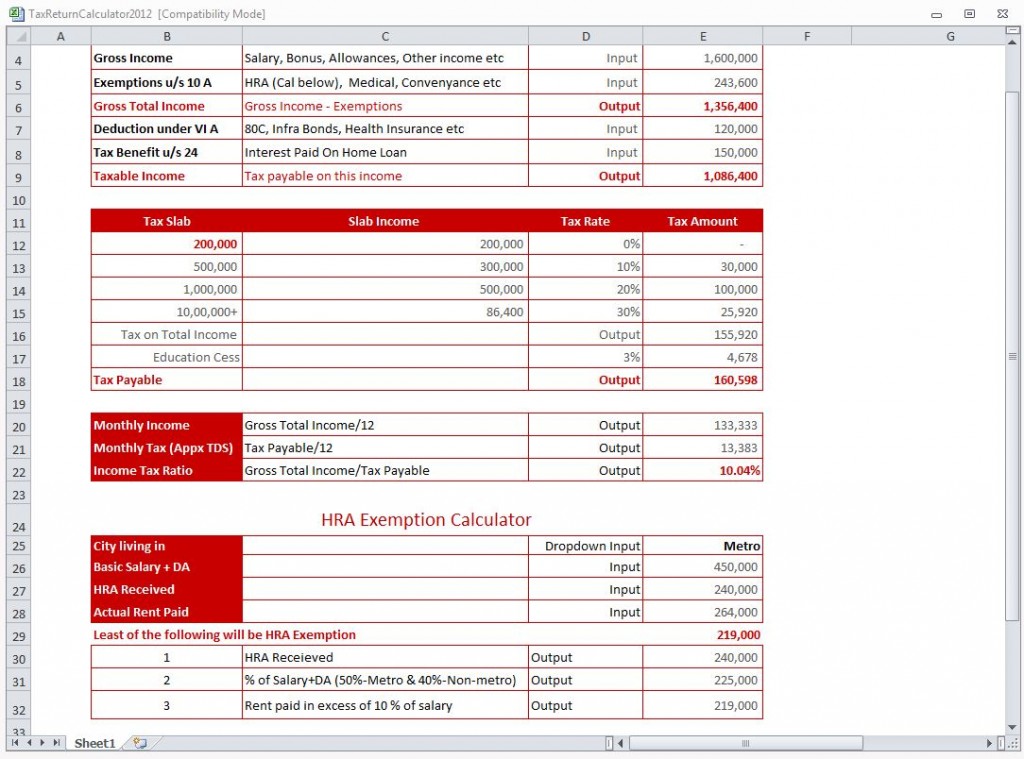

With the Tax Return Calculator 2012 from ExcelTemplates.net, taxpayers can effectively:

- Manage, store and map their individual economic characteristics.

- Project tax slabs, slab income, tax rates and tax amounts.

- Perform an HRA Exemption calculation

How to Use the Tax Return Calculator 2012

- First, you’ll need to indicate any particulars regarding your income, payee time, total exemptions, gross total income, deductions, tax benefits, and taxable income.

- After you’ve entered these details, use the tax return calculator to configure each respective amount. These figures will be your building blocks for a successful tax return come April.

- Next, you’ll want to indicate your tax slabs, slab income, tax rate and tax amount. This will configure to a total output near the bottom right-hand corner of the template.

- Monthly income, monthly taxes and income tax ratio will be your final calculations.

The Tax Return Calculator 2012 comes with a pre-made template for reference. However, if you’re unsure of any of these terms, or at all confused about where you might stand economically, consider enlisting the help of a certified tax expert. The IRS provides free courses for a number of locations.

Using the HRA Exemption Calculator

HRA, or “house rent allowance”, can play a pivotal role in your tax filings. And although anyone can claim tax exemption for their HRA, there are a couple of key factors to keep in mind.

First, the amount you would be able to keep exempt would be the least of the HRA printed on your pay stub, or 40 to 40 percent of your basic salary plus dearness allowance. Or, the exemption could consist of your rent minus 10 percent of your basic salary plus dearness allowance.

In your Tax Return Calculator 2012, be sure to specify your city, salary, HRA received and actual rent paid, as these will all help to configure your final HRA exemption.

Download: Tax Return Calculator 2012

Related Templates:

- Federal Tax Calculator 2012

- 2012 Tax Calculator

- Excel Tax Return Workpapers Preparation Template

- Excel Payroll Calculator

- Corporate Tax Calculator

View this offer while you wait!