An Excel template is one of the more quality tools you can use when looking to make financial evaluations. When using an Excel template one of the more common things you can use it for is a detailed budget planner. This is a way of keeping track of all of your household income and expenses.

By using this planner you will have the ability to more carefully evaluate your financial situation and make sure that you are making enough money to stay afloat. When looking to use the budget planner you will want to keep track of your monthly income and your monthly expenses. This will allow you to ensure that you know how your money is being allocated on a monthly basis.

Monthly Income Budget Planning

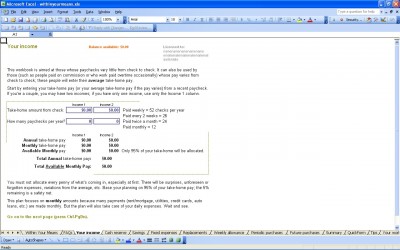

The first part of the budget planner on the Excel template is the monthly income. This is a part of the budget plan that consists of the amount of money you make. In this template you will go over your income both before and after taxes. This will allow you to know exactly how much money you are making on a monthly basis. As a result you will have the means to evaluate whether or not you are making enough money to cover expenses both before and after taxes.

Monthly Expenses Detailed Budget Planner

When using a budget planner another important thing you will need to go over is the monthly expenses. This is the amount of money you will need to pay for things such as housing, food, utilities, car payments and health insurance. When going over these things you will have an easy way to see how much of your income you must allocate to your expenses and allow you to plan more efficiently in regards to your money. Using the budget planner template on Excel will give you a very effective tool to evaluate your financial situation more easily.

Related Templates:

- Financial Profile

- Monthly Cash Flow Plan

- Budget Calculator Excel Spreadsheet

- Budget Planner

- Home Budget

View this offer while you wait!