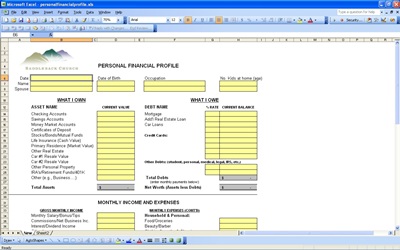

Personal finances are among the most important aspects of a person’s life. When looking to get a home or a car it is very important to have a financial profile. A profile is a financial statement regarding your personal finances. When looking to put together a personal financial file you will benefit by making one on Excel.

On Excel you will have the means to make a very clear and organized profile of your personal finances. If you are looking to make a financial file of your personal finances then you will want to include your assets, liabilities and also your monthly income and expenses.

Financial Profile: Assets and Liabilities

One of the key parts of the profile is the assets and liabilities. This is the listing of all of the things you own and also what you owe. The things you own will usually include your checking account balances, your savings account balances and also stocks, bonds and mutual funds you may own.

On the other side of the profile you will have liabilities which are things you owe such as mortgages, car loans and credit card debts. With this part of the profile you will have the means evaluate what you have in relation to what you owe and this will help determine if you are in good financial standing or not.

Financial Profile: Income and Expenses

Another part of the profile is the monthly income and expenses. This is the amount of money you make each month in relation to the amount you pay. With the monthly income and expenses you can assess how much money is coming in and going out. As a result you will have the ability to go over your monthly cash flow.

Having this as part of the profile will allow you to have a better understanding of your finances. This is what the Excel template can do for you when tracking your personal finances.

Related Templates:

- Detailed Budget Planner

- Monthly Cash Flow Plan

- Opening Day Spreadsheet

- P&L Statement Template

- Monthly Budget Planning Spreadsheet Excel Template

View this offer while you wait!