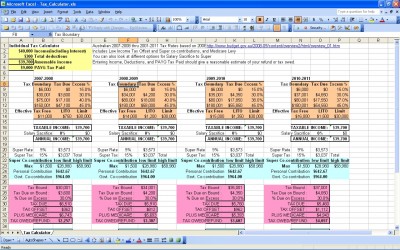

Taxes can be very complicated. Australia is trying to simplify their tax policy by reducing the personal income tax rates to three. This will make calculating the tax due on income simpler. The Australian tax calculator spreadsheet is based on current Australian tax policy and makes calculating and tracking income tax possible at the various tax rate levels.

Completing the Australian tax calculator spreadsheet during the year will allow the person to keep up with his or her tax liability as income is earned. It helps to know how much to set aside for tax payments to keep from falling behind and then having to pay penalties.

The spreadsheet will also accounting system. If an accrual based accounting system is maintained the taxes payable will need to be entered onto the books before they are actually paid. Using the spreadsheet will help determine the amount of taxes payable on a current basis.

This spreadsheet can also be used for financial planning purposes. For example, what if scenarios can be set up to plan for future events? What if a certain income is achieved, how much will the taxes be and where will the money come from? Questions like these can be asked and plans made for the future that help maintain control of the finances.

Is there a way to lower taxes while maintaining current revenue levels? Should reinvestment be made in capital items for the business? If the business is in the 45% bracket and equipment is bought that reduces taxable income by $40,000 there is a tax savings of $18,000. This type of planning can help take any business to the next level.

Careful financial planning in a business leads to success because every move that is made has a better chance of being a successful move and generating needed revenue in one way or another.

Related Templates:

- Singapore Basic Tax Calculator

- Proforma Income Statement

- Opening Day Spreadsheet

- Finance Calculator

- The Top 5 Excel Accounting Templates for Small Business Owners

View this offer while you wait!