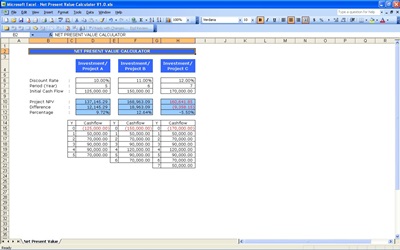

Net present value (NPV) is a common financial calculation used to determine the profitability of an investment or project. Net present value can be calculated by hand, although it may be easier to use an NPV calculator to avoid errors. This Excel spreadsheet has a sample Excel net present value model and built-in NPV calculator. You can use this NPV calculator in the worksheet to do your own net present value calculations.

When performing the Excel net present value calculation, certain fields must be entered into the NPV calculator:

- Discount rate

- Number of years (for the investment/project)

- Initial cost (negative value)

- Projected cash flow per year

If you are missing any of the values, the NPV calculator will not return proper results. Your initial cost is considered a cash outflow, and should always be entered as a negative value in the NPV calculator.

This NPV Excel template has three example investment projects already done for you. You can click on individual cells within NPV Excel file to see the formulas used to calculate the Excel net present value. The row titled ‘Project NPV’ displays your net present value for the specified investment. The first two examples, Project A and Project B, have positive net present values. The Excel net present value for Project C is a negative value highlighted in red. You will also notice that the NPV calculator has calculated a negative difference and percentage. If you need to include more projected cash flows, you can edit the NPV Excel template by adding more rows and changing the number of years for the investment.

This NPV calculator is simple and easy to use. Download this free NPV calculator from the link below. Be sure to browse our library of free Excel templates for more useful Excel calculator templates like this NPV calculator.

Related Templates:

- Present Value Calculator

- IRR Financial Calculator

- Present Value Mortgage Calculator

- NPV Excel Template

- Net Present Value Calculator

View this offer while you wait!

This seems to be good and useful