Deferring your taxes is sometimes necessary but it can also be quite challenging and consuming. You may not know exactly what you’re getting after deferring taxes and paid interest. The Deferred Tax Rate Template allows you to visualize the effects of your deferment before you take any action at all. The simple structure of the template was designed for you to go in and enter all the data that the template lays out for you and in turn will provide you with the calculations you need. You can download the Tax Rate template absolutely free.

How to Use the Deferred Tax Rate Template

After successfully downloading the template to your computer you can easily see how the template works. To the left of the page, you’ll see a graph that illustrates the difference in payment between your nontaxable rate and the interest rate.

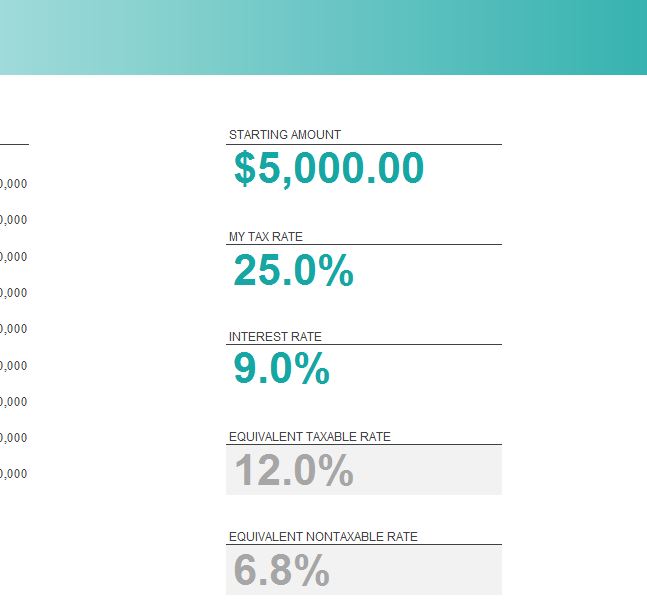

To the right of the page is where you will enter all the details of your loan or payment. Start by listing the starting amount at the top of your screen. The example lists “$5,000” as the starting amount.

Next, enter the interest rate of your loan or payment. The template is set to automatically reformat all amounts you enter into these categories as either a percentage of a dollar amount so all you need to write down is the amount.

Once you have those three numbers written into the correct spaces you will see a calculation compiled at the bottom that gives you the taxable rate and the nontaxable rate of your loan or payment. As an added bonus, you will also see a graph that compares these two figures to display a perfect visual so you know exactly what you’re getting by the end of your transaction.

Never be left in the dark about your next purchase again, download the Deferred Tax Rate Template now.

Download: Deferred Tax Rate Template

Related Templates:

- Loan Analysis Worksheet

- Car Loan Payment Calculator

- Excel Loan Calculator

- Balloon Loan Payment Calculator

- Biweekly Mortgage Payment Amortization

View this offer while you wait!