Using the Mortgage Affordability Calculator

Mortgage affordability is an important factor that has to be taken into consideration before looking for a home. It is simply how much you can comfortably afford and should determine the budget, even if you were approved for a higher amount.

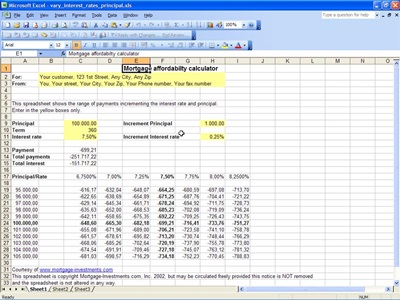

The mortgage affordability calculator uses your financial information to determine just how much you can pay each month for a home. The affordability is calculated after entering information like your monthly gross income, outstanding debts and amount of down payment.

Advantages of Knowing Mortgage Affordability

Knowing how high of a mortgage you can afford each month can potentially save you from a lot of problems down the road. Not over-extending yourself financially will help you to avoid stress, financial difficulties and possibly even foreclosure.

Related Templates:

- Home Affordability Analyzer

- Mortgage Qualification Calculation Spreadsheet

- Mortgage Payment Calculator

- Present Value Mortgage Calculator

- Reverse Mortgage Calculator

View this offer while you wait!