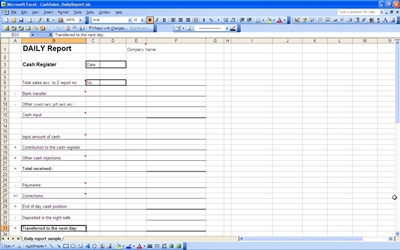

Having a daily cash transaction report will go along way to enhancing the financial records of any business that takes in cash payments.

When we talk about cash in terms of a daily transaction report we are talking about any payment received, including checks and credit card payments. One person should be designated to be in charge of this report, per store, and that person should not have any other responsibilities regarding cash transactions.

Businesses need to separate duties when it comes to the finances so that no one person can cover up financial irregularities. This separation of duties becomes a system of checks and balances that serve to keep employees honest. Many people will steal from an employer if they see an opportunity and think they will get away with it. With strong controls in place employees will not have the opportunity to steal.

The daily cash transaction report is an independent report of every cash transaction for the day. It can reconciled to other reports, such as bank deposits, customer accounts, receiving reports for purchases, etc.

At the end of the month the daily cash transaction reports should be reconciled to bank deposits, the cash account and any other relevant accounts. this reconciliation is balancing and closing the books for the month. Each month businesses should close their books and produce financial statements.

This is how the business owners know the results of their business and its financial position. It is also how they can tell if there is anything wrong with the financial records. For example, if controls are not being followed properly or if something does not reconcile properly. In these cases the owners would know to investigate further and to check more closely on employees.

Not all businesses have the resources to properly divide duties among employees. If this is the case then compensating controls are needed. For example, the business owner might double check the daily cash transaction report and/or the bank deposits to make sure they reconcile to related records. A business owner can never be to careful when it comes money in the business.

Related Templates:

- Daily Cash Sheet

- Cash Flow Projection

- Petty Cash Log

- Small Business Organizational Chart

- Financial Forecast Report

View this offer while you wait!