There are many situations in which the NPV Excel template will come in handy. If you are a business person, you have probably already heard of the term NPV or Net Present Value. If you have not, it is a very simple concept to understand.

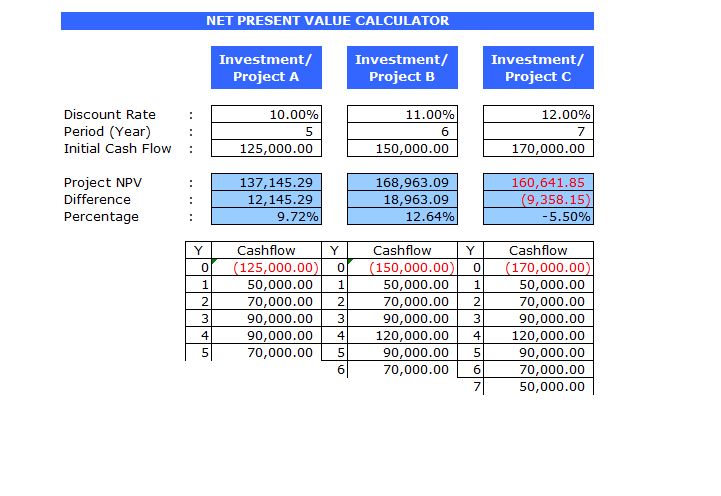

When a business person or investor is thinking of starting a new project, investing in a new business or starting a new business, he or she has to figure out whether it is a good idea to put money towards these efforts or not. The NPV is the difference between the cash coming in versus the present value of the cash going out.

In addition to NPV, there are other factors that many people in investment positions consider including the PP (payback period), the ARR (average rate of return) and the IRR (internal rate of return). However, the NPV is a crucial indicator of whether or not you should make a financial decision. If the NPV is negative then you should run away fast. If it is positive, then you have a better indicator of a good outcome.

How to Use Your NPV Excel Template

First, you must bring your new investment, new idea, new business or new project to mind. Then gather all of the information that you have, especially all of the financial information you have, and plug it into the Excel file.

The great thing about this NPV Excel template being an Excel file is that you can always save a copy under a new name, if you want to look it over at a later time or save it and send it to someone else. Once you plug in the appropriate numbers your NPV Excel template will work automatically and you will have your investment answer. This template was created by a person with the real world business experience of owning several companies.

Tips for Using Your NPV Excel Template

Of course, in reality, nobody can predict the future. However, a NPV Excel template can help you to make a well-informed decision. For example, if a friend has approached you to invest in his new bistro. If your investment is going to be $100,000 and you would own ¼ of his business with that, you should look at the NPV of that business.

If ¼ of it is greater than $100,000 presently, then chances are, you are making a really good choice. If it will be higher in a year or two, you might want to be a little cautious, but it still might be a good investment. If it is negative for many years to come, there is no reason for you to invest.

Download: NPV Excel Template

Related Templates:

- NPV Calculator

- IRR Financial Calculator

- Start Up Expenses Template

- Delay a Project Template

- Net Present Value Calculator

View this offer while you wait!