A person or group in the right position can make a very profitable decision by deciding to purchase an existing business. However, diving head first into a business opportunity can also be a dangerous and risky endeavor. There are dozens of ways to evaluate buying an existing business, but many of these ways are conducted by third parties and cost an exorbitant amount of money. However, a business valuation calculator is the easy and affordable alternative.

This calculator can provide you with all the necessary facts and figures to make an educated decision. It also potentially could be the difference in making or losing a significant amount of money. Unlike other business valuation methods, this calculator won’t cost you a penny. It can also be yours for nothing more than a single click of your mouse.

The Value of the Business Valuation Calculator

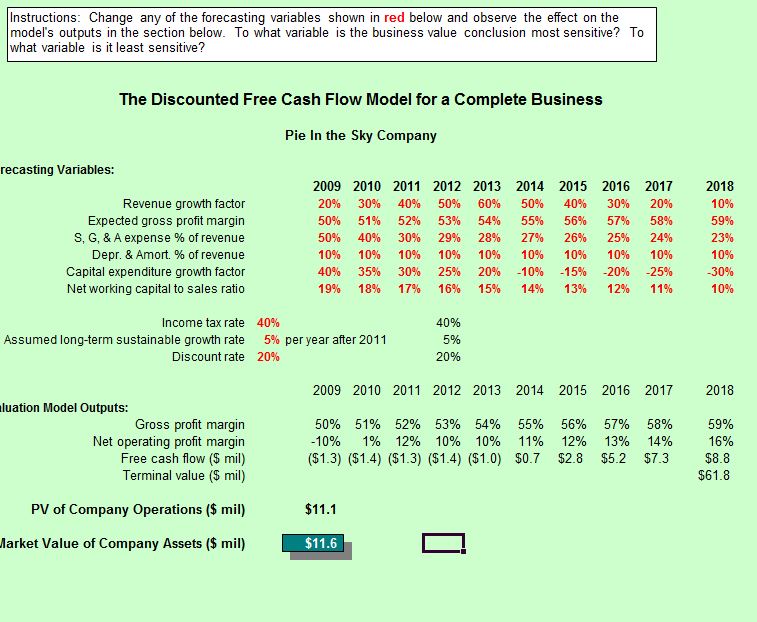

The calculator, which is very easy to use and understand, employs the free cash flow business valuation model. The calculator takes a look at several things in the “Forecasting Variables” section, including:

- Revenue Growth Factor

- Expected Gross Profit Margin

- Selling, General, & Administrative Expense % of Revenue

- Depreciation and Amortization % of Revenue

- Capital Expenditure Growth Factor

- Networking Capital to Sales Ratio

- Income Tax Rate

- Assumed Long-Term Sustainable Growth Rate

- Discount Rate

The valuation calculator will forecast these variables for a 10-year period. The period can be changed by putting in the appropriate year in the first column. The rest of the years will automatically change after entering the first year.

If you wish to choose any of the forecasting variables, simply change the numbers that are marked in red. This will have an effect on the rest of the model’s outputs, and will reveal what the most and least sensitive variables to the business value conclusion are.

The calculator also uses valuation model outputs, including gross profit margin, net operating profit margin, free cash flow and terminal value. All of this information will help determine the present value of company operations and the overall market value of company assets. The decision of whether or not to purchase an existing business will be an informed one thanks to the valuation calculator.

Download: Business Valuation Calculator

Related Templates:

- Cash Flow ROI Valuation Model Audit

- Free Cash Flow

- Bond Valuation

- Capital Budget Template

- IRR Financial Calculator

View this offer while you wait!