To get a better understanding or your business’s equity value or property or even a project, you can use the free Capital Budget Template to calculate the prospective cash-flow. This free template document uses certain data that you will have on-hand to calculate the worth of your equity property. All you need to do is fill in a few figures and the template will take care of the rest. Nothing is easier than using this free template. If you’re ready to get started with a template that will not only provide you with the NPV but also the ROC of your equity, then follow the set of instructions below.

Using the Capital Budget Template

To download this free template file, go to the link at the bottom of this page and follow it to begin the downloading process.

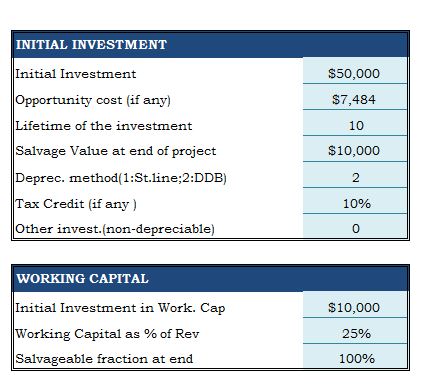

At the top of the template, you will notice a few different tables with blue cells highlighted. In these blue cells, you will replace the example information with your own.

Start by listing the initial investment information, then your working capital, cash-flow details, and discount rates (if applicable).

Finally, you will receive helpful data back. In the growth rate section of the template, you will find the revenue and your fixed expenses, initial investment recap, salvage value of the equity and the operating cash-flow data.

There are also some helpful tips off to the side of the template to keep you on track!

This template has everything you need to assess the value of an upcoming business decision based on equity. Not only will you be able to calculate loss and profit, without risking anything, but you can continue to use this free template time and time again.

Why You Should Use the Capital Budget Template

- Calculates totals automatically.

- Only requires a few pieces of information

- Easily customizable.

Download: Capital Budget Template

Related Templates:

- IRR Financial Calculator

- NPV Calculator

- Cash Flow Budget Sensitivity Analysis

- Delay a Project Template

- NPV Rule for Capital Budgeting

View this offer while you wait!