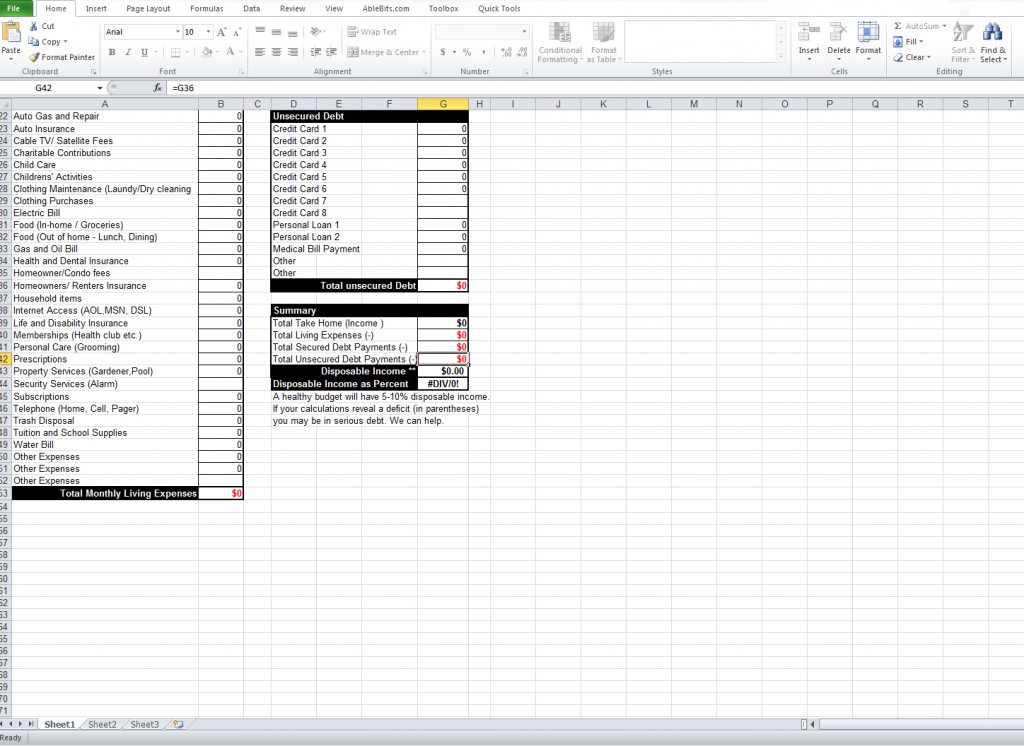

Every household needs a budget to manage spending. Without a budget it is difficult to know where all the money goes. Unless the household is wealthy a budget is necessary to live within financial limits and pay all the bills. The budget shows where the money goes and how much is spent on each item.

It also shows where cut backs are needed and where unnecessary spending is occurring. It allows for adjustments to be made in spending so that the monthly necessaries are covered and wasteful spending is eliminated. The budget should also allow for savings for the future. A household budget worksheet is a big help in devising a budget.

The household can use the budget to change spending habits to keep from going over budget. This will prevent the need to use credit to pay living expenses which in turn will help prevent debt from being accumulated. Debt is how many household get into financial trouble, interest and fees eat into monthly earnings leaving to little for living expenses, which leads to more debt.

Changing spending habits by cutting back where ever possible and avoiding blind spending leads to having control over the household finances.

Writing down each item of spending provides information needed to plan and make good decisions. Over time the historical data will show where adjustments are needed and help with setting reasonable goals for the future. The household budget worksheet is a tool that can be used to keep track of a budget monthly spending.

Saving a set amount each month as part of the budget is a good idea, that way a little bit is saved each month on a regular basis. Relaying on money left over at the end of the month for savings is to haphazard.

Having an emergency fund is important so that when financial emergencies happen the household is prepared. Things like car repairs or a layoff from work can happen without warning and if not prepared can wreak havoc on finances, even require going further into debt. By establishing an emergency fund and maintaining a set amount on hand, set backs can be handled with ease and not throw the household off track.

A budget produces accountability for spending because with a budget there is no excuse for not knowing exactly where the money goes.

Related Templates:

- Household Expenses Calculator

- Household Budget Template

- Monthly Budget Worksheet

- Family Budget Worksheet

- Household Expenses Template

View this offer while you wait!