Purchasing a home is a big decision. A person has to decide what features they are looking for such as number of bathrooms or bedrooms. They also have to decide on a location they want to live in.

Purchasing a home is a big decision. A person has to decide what features they are looking for such as number of bathrooms or bedrooms. They also have to decide on a location they want to live in.

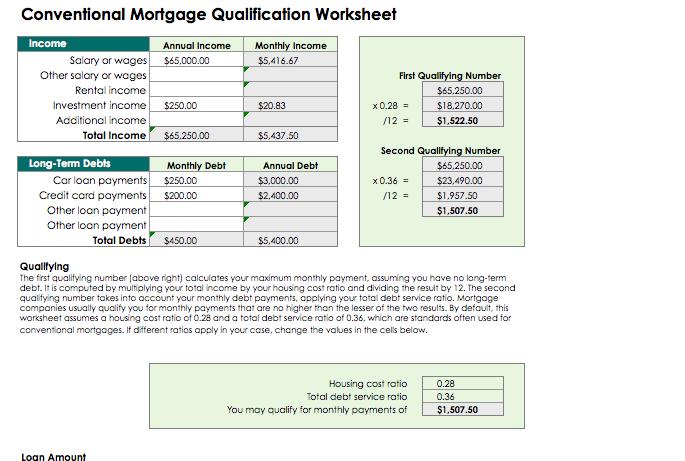

Above all a person has to figure out how much money they are able to afford a month between paying a mortgage, property tax, and home owners insurance. There is help for a person to figure out their budget. A mortgage qualification calculation spreadsheet can help a person figure out monthly payments, what size home they can afford.

The spreadsheet calculator combines the features of the mortgage and loan calculators in one easy to use sheet. A person can type in the total price of the home and how many years they would like their mortgage to be.

Most mortgages last between fifteen and thirty years. A person also has to add the interest rate that they have been pre-approved for or they think they will be approved for. They also enter the areas and the property taxes for that area. This spreadsheet will then calculate expected monthly payments.

This will give a person an idea if they can afford a home of that price or not. The spreadsheet will also graph the expected value of the home over time. A person can see if the value of the home is expected to go up or to go down.

While these numbers may not be the exact amount and nothing is final with the mortgage calculator but it does give a person a fairly accurate view of what they will be expected to pay each month. Since this spreadsheet is on Excel the totals can be adjusted as needed. It can also be saved on the computer and printed out and brought to a mortgage company to compare rates.

Download: mortgage-qualification-calculation-spreadsheet

Related Templates:

- Excel Mortgage Calculator Template

- Car Loan Payment Calculator

- Buy vs Lease Car Calculator

- Mortgage Affordability Calculator

- Home Affordability Analyzer

View this offer while you wait!