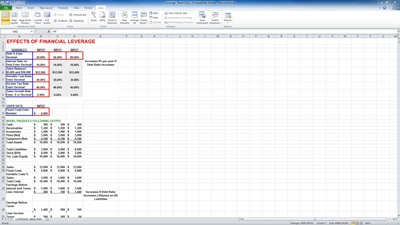

One of the business practices that has been on the increase are leveraged buy outs. These buy outs are accomplished by a company buying another company through high equity loans and bonds. The company buying the other company then uses the cash flow of the newly-acquired company to pay off the debt. Is short, this can be risky. That is the main reason a company pursuing this practice should use a leverage analysis Excel template. There is a lot of risk involved in this sort of business arrangement. That is why companies pursuing other businesses in this manner need to be careful.

Related Templates:

- Company Analysis

- Leverage Buy Out Model

- SWOT Analysis

- Merger Financial Plan

- Real Estate Rehab Profitability Analysis

X

Your free template will download in 5 seconds.

View this offer while you wait!

View this offer while you wait!