It is a great feeling when you are able to accomplish something in a short period of time that usually would have taken much longer. People gain great satisfaction out of being able to use technology to make this experience possible for themselves.

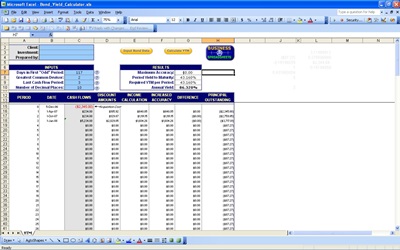

One of the ways that some have found to make figuring out bonds a little easier is to use their excel spreadsheets as a bond yield calculator. Believe it or not, you can quickly and easily figure out the exact figures you need to know about by just plugging in the information you already know.

How Does It Work?

By entering all of the information you already have about your bond such as the interest percentage received and the amount you have in the bond, you can quickly figure out how much you will earn. The best part is that the bond yield calculator can figure out the exact amount of interest that will be paid from the present until the maturity of the bond. This means that you will never be left guessing.

Benefits

You can start to realize the benefits of using a bond yield calculator immediately. You will see that you are able to plan out your financial future more accurately and with great success if you are able to understand the exact amount that you will be receiving from now into the future.

Doing things this way is certainly a lot better than trying to do all of the work by hand, and you will not have to deal with many of the other annoyances that come with trying to figure out this information for yourself (such as possible human error). When the excel spreadsheet is doing all of the work for you, you can just sit back and enjoy the results.

Related Templates:

- Bond Valuation

- Quarterly Sales Commission Calculator

- Car Loan Payment Calculator

- Mortgage Payment Calculator

- Benefit Calculator

View this offer while you wait!