It is important to run a business efficiently. That includes knowing your income as well as expenses. As much as you would like to pay your suppliers, equipment loans, bank loans, or trade creditors back, you may not be able to do so upon invoice. The Business Debt Schedule Template is designed for small businesses to maintain accurate tracking of those debts.

This template helps you maintain your important business reputation, by keeping track of what debts you have that are outstanding. Furthermore, it is important to have an accurate timeline together of when you may be able to be in the clear.

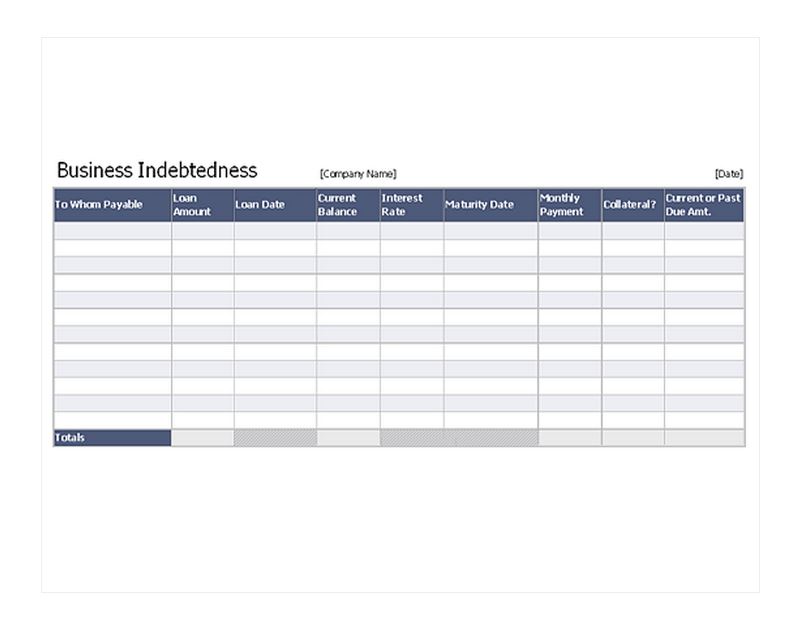

How to Use the Business Debt Schedule Template

Once you have downloaded this free and easy to use template, you can get started right away. This debt schedule is fully customizable in Excel.

- Step 1: During the initial setup, you want to include your company name and the date. If it is easier for you, you can use this spreadsheet monthly.

- Step 2: Now it’s time to fill in the important data such as who you owe, the original loan amount, the date you acquired the loan, your current balance, the interest rate, maturity date of the loan, your monthly payment, if you placed anything up for collateral, and any past due amount.

- Step 3: You can view your totals at the bottom of the columns.

Tips for Using the Business Debt Schedule Template

- Again, as the Business Debt Schedule Template is customizable, add comments where necessary. For instance, to make it easier to send a check, add the address, email account information, or bank account information in a comment in the field for the entity’s name. Select Insert and comment on that field.

- To set up monthly tabs, select the drop down menu option Insert and select Sheet.

- If you decide to keep a running total, you can use the AutoFilter shortcut to sort or filter by loan amount, the month the loan was acquired, monthly payments, or past due.

- If there were anything else helpful such as early payoff agreements you would like to include, add a new column at the end. You can attach the links to your agreements here as well to find them easily.

The Business Debt Schedule Template found here makes it easy and affordable for small business to have the financial documentation they need to keep their business on track.

Download: Business Debt Schedule Template

Related Templates:

- Loan Payoff Calculator Excel

- Debt-to-Income (DTI) Ratio Calculator

- Amortization Schedule

- Balloon Loan Payment Calculator

- Debt Repayment Calculator

View this offer while you wait!