Property values depreciate at different rates depending on a number of factors and it’s best to know which property you want to stick with after calculating the best one to take. The Depreciation Calculation Sheet is the best tool to determine which property you want. Whether you need a new home or you need a property to rent out for extra income, this template can help you through all the small details. The free template allows you to calculate deprecation for your home after 5, 7, 10, and even 15 years down the road. If you’re ready to get started, click the link at the bottom of this page to begin.

How to Use the Depreciation Calculation Sheet

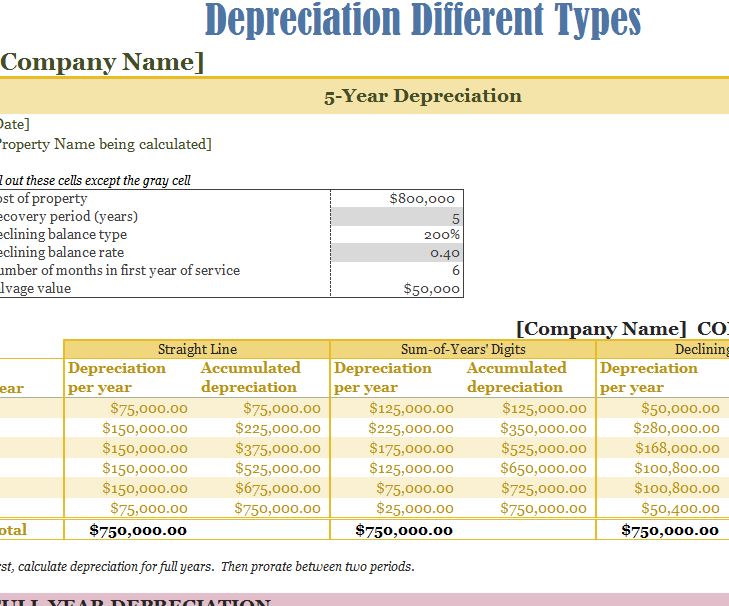

First, at the bottom of this page, you will need to select the “5-Year Depreciation” tab. This is where you will begin your journey.

Enter your name and the property information in the brackets at the top of the page. Next, the box outlined in gray is the area where all your main information will go. The template makes it very quick and easy to get the information you need.

Enter the cost of the property, recovery period, declining balance type, the number of years within your first year of service, and the salvage value. The template will give you the “Declining Balance Rate.”

In the tables below, you can see the estimated depreciation value of your home in three different methods of depreciation. You will also see the depreciation after your years of service at the bottom of the template.

You can go through each of the tabs in the template to see how your property will depreciate over the next 7, 10, and 15 years as well.

Why You Should Use the Depreciation Calculation Sheet

- Calculations are done automatically.

- Only requires 5 pieces of information.

- Template is fully customizable for your property.

Download: Depreciation Calculation Sheet

Related Templates:

- Depreciation Calculation Sheet

- Depreciation Calculator

- Mortgage Qualification Calculation Spreadsheet

- Operating Lease Converter

- Property Construction Budget Calculator

View this offer while you wait!