If you’re currently suffering from debt and you feel the weight coming down on you day after day, you’re actually not alone, many Americans suffer from some form of debt and they work day and night to try and relieve that stress each month by paying the minimum. If this sounds familiar to you, then you need to rework your strategy. The free Credit Card Payoff Calculator is the perfect tool to help you step out of debt once and for all by first analyzing your payments and then helping you come up with a budget that actually works for your income. If you’re ready to become debt-free, the first step is waiting for you in this template.

Using the Credit Card Payoff Calculator

The first thing that you need to do is download the free template by clicking the link at the bottom of this page.

Now, go to the “Credit Card Entries” table at the very top of the page. This is where you will enter your credit card information, such as the amount you owe, the interest rate, etc. In this section, the white cells are what you need to fill in with your own information.

The template may look a little complex at first, but with a few simple entries of things you already know, you’ll receive some helpful feedback at the end.

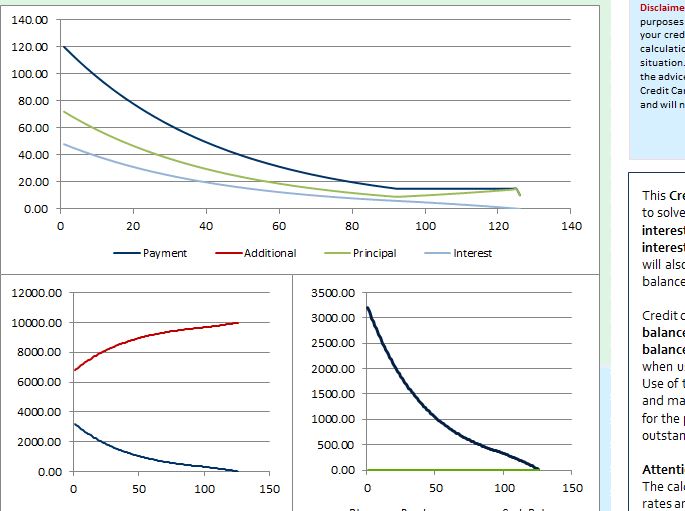

In the blue “Results” section of this template, you can see the number of months it will take to pay your bill off, the interest that will be paid over time, and then so much more.

Using this free template, you can see how paying the minimum on your cards is not a sound strategy. Over time, you could end up paying 3 or 4 times the initial cost, which is exactly what lenders want from you.

Reasons to Use the Credit Card Payoff Calculator

- Calculates totals automatically.

- Graphs that show interest rates over time.

- All payments shown through the entire course of payment plan.

Download: Credit Card Payoff Calculator

Related Templates:

- Credit Card Payoff Calculator

- Credit Card Payment Calculator

- Debt Snowball Calculator

- Credit Card Excel Template

- Loan Payoff Calculator Excel

View this offer while you wait!