There are a lot of people who talk about refinancing their mortgage, but not all are sure if it is right for them. The question can actually be discovered mathematically and through the use of technologies that can aid in this kind of thing.

Many people find that by using a mortgage refinance calculator, they are able to discover if this is the right thing for them to do in their financial life or not. That is obviously critical if you care about how much you are going to save on your mortgage.

What Does A Mortgage Refinance Calculator Do?

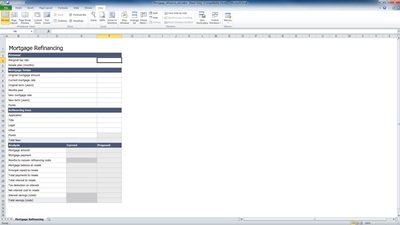

By entering in all of the information into your mortgage calculator program on excel, you can quickly discover if you are making the right decision by going through with a reverse mortgage or not.

All that you really need to know is how much you are paying in interest right now versus how much you would be paying in the event that you decided that you would go through with the refinance. That is something that can actually be legitimately determined through the use of this program.

Should I Get A Mortgage Refinance?

The question about if you should refinance your mortgage or not should pretty well be answered by the calculator itself. It will help you to determine if there is anything that can or cannot be done. You will find that you should be able to do the figuring with the numbers that it spits out for you to see if refinancing your mortgage is right in your particular situation.

For most people the answer is going to be yes, particularly if they can get a significantly lower rate than what they are currently paying in interest. This is not always the case, but many people are able to pull this off.

Related Templates:

- Refinance Mortgage Loan Calculator

- Mortgage Loan Refinance Calculator

- Loan Payment Calculator Excel

- Mortgage Comparison Calculator

- Mortgage Payment Calculator

View this offer while you wait!