Accepting a loan with installment payments can be quite costly. The borrower is wise to weigh the available loan options before accepting the best extended payment plan to meet his or her particular circumstances. This is especially true for vehicle loans. One wrong loan choice and you could end up paying thousands more than you needed to in order to own the car of your dreams. By using the handy Vehicle Loan Payment Calculator, some of the mystery surrounding your loan can be revealed before you agree to the obligation.

Reasons to Use the Vehicle Loan Payment Calculator

The Vehicle Loan Payment Calculator can make budgeting for a new car far easier and more accurate than simply waiting until the loan paperwork is prepared and waiting for your signature. The calculator is free to download and it’s easy to use. Most importantly, it’s customizable; use it to get accurate numbers based on the amount borrowed, the interest and the number of years for the loan repayment. Having those numbers in advance helps you make choices that would be more favorable.

After using the vehicle loan payment calculator, perhaps you would be better off with a shorter loan period and higher payments, especially if you could also get a loan with less interest. By comparing all the features of the loan, the borrower is better equipped to make a decision about the best loan for him or her.

How to Use the Vehicle Loan Payment Calculator

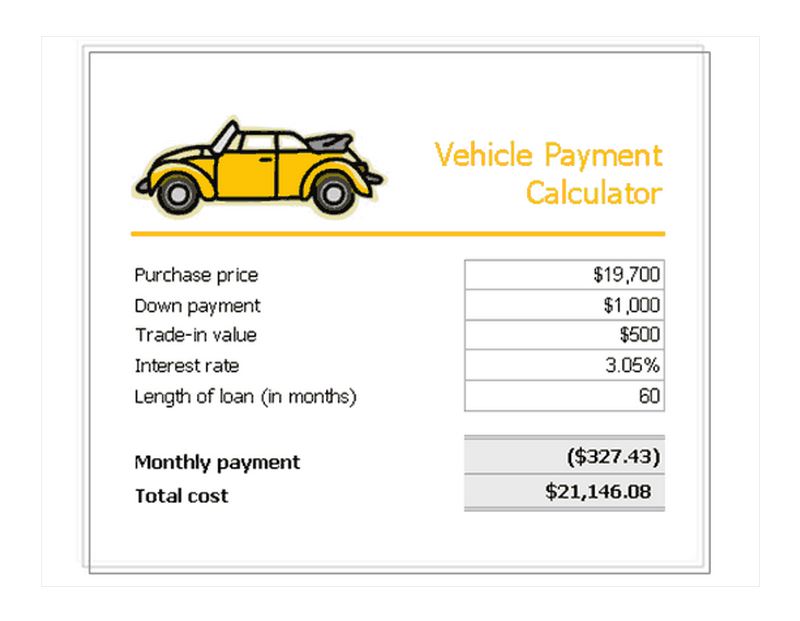

- First, enter your estimated price. The marked price may be $25,456 and you may be able to get the salesman to accept $24,800.

- Second, enter the amount of your down payment. You may adjust this amount if you have the available funds and decide the final calculations are not acceptable. The monthly payment may be too high or too low. Adjusting the down payment will adjust the monthly payment.

- Third, enter your trade-in vehicle’s value. You may or may not have a vehicle to trade-in. If you do include it in the calculator, so that accurate numbers can be generated, if not leave the entry blank.

- Fourth, enter in the interest rate for which your loan has qualified. This entry may change if you are shopping around for a loan. The banks or the dealerships may be offering significantly different terms. By comparing them point by point you may find that the one with the oddest collection of figures works far better for you than the one you originally thought was best.

- Fifth, enter the length of the loan in months. The average car loan is 36, 48, 60 or 72 months or 3, 4, 5 or 6 years. By adjusting the loan period, the payment will also change.

- Sixth, see the calculated monthly payment.

- Seventh, see the final total cost of the vehicle after interest and principal payments have been added.

Managing your personal finances requires forethought and planning. The Vehicle Loan Payment Calculator is an essential tool for the person serious about maintaining his or her budget. Keep your budget on target by downloading the calculator today.

Download: Vehicle Loan Payment Calculator

Related Templates:

- Car Loan Payment Calculator

- Balloon Loan Payment Calculator

- Loan Analysis Worksheet

- Excel Loan Calculator

- Loan Payment Calculator Excel

View this offer while you wait!