Most people want to have enough life insurance to replace their income should they die an untimely death. This is to protect family members from the loss of income and the resulting financial problems. Life insurance should be part of comprehensive financial planning.

When a person sets up a financial plan he or she should determine how much life insurance it would take to replace income for the remaining working years and to provide for retirement after that. Determining the amount of life insurance that is necessary is a matter of deciding on the lifestyle necessary for survivors and determining how much monthly or annual income is needed to provide the desired lifestyle.

Also, certain items should be taken into consideration, such as college for children if there are any, health insurance for the family and other necessary expenses.

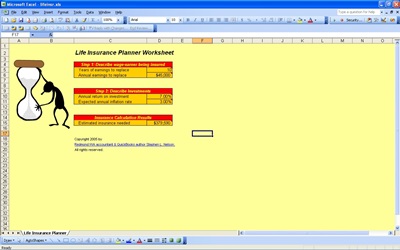

Using the Life Insurance Planner can help people determine the amount of life insurance to buy. Using this spreadsheet it is possible to try out different scenarios, for example, whole life is expensive but it has a savings feature and eventually is paid up so that the interest pays the insurance. A person could start off with a smaller amount of whole life and some less expensive term insurance.

As the persons income grows the whole life amount is increased and the term amount is decreased. Eventually the whole life is paid off and has grown to a large amount which can then be used for retirement because it has a cash surrender value. The term insurance can be allowed to expire because it is no longer needed, but over the years the term insurance is in place just in case tragedy should strike.

Using the Life Insurance Planner a person can set goals for future savings and insurance to ensure a secure future for one’s family. A financial plan should include savings, insurance, a home, and a pension, if the person lives to old age and all of these parts of the financial puzzle payoff there should be no financial problems, but if the bread winner dies early the insurance needs to replace the other parts of the plan.

That is why planning for insurance in important. To much insurance can be a waste, and result is less savings, to little insurance and there could be a big hole in the plan that leaves the family vulnerable.

Related Templates:

- Simple Retirement Planner Spreadsheet

- Detailed Budget Planner

- Australian Tax Calculator

- Family Budget Template

- Financial Profile

View this offer while you wait!