Before we can discuss an optimal hedging strategy, we must discuss what is hedging in the first place. Basically, hedging is an investment action that is designed to reduce the risk of a volatile investment through “locking” the price of the investment for the future.

A good example of this hedging strategy would be a cotton farmer who wants to protect his selling price in case the cotton prices in the future might drop. Therefore he hedges his commodity at a certain price and at agreed time even before his cotton are not yet ripe enough for selling. By doing so, he then reduces his risk in regards to price fluctuations.

Hedging is not limited only to commodities like cotton or corn. Hedging is applicable to almost any kind of investment and securities such as asset, stocks or bonds.

When it comes to hedging, especially with commodities, producers and speculators have a slightly different perspective. Producers typically hedge with the intention of securing their products. Speculators and traders hedge with the intention of making profit from their market position. Traders make profit from market inefficiencies by locking the price of a certain investment in the near future with the hopes of selling it higher than the hedge price. This kind of hedging strategy is viable but not without its ups and downs.

Hedging can be a intimidating for many traders. One reason for this is that prices are rarely in 1:1 ratio. On top of that, the ratios do not stagnate. Without the proper tools, it is easy to lose money through hedging.

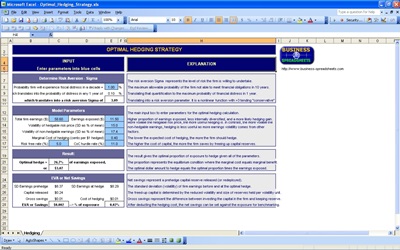

Fortunately, there are tools that help you in getting the optimal hedging strategy. One tool worth mentioning is spreadsheets that automatically calculate the variables so that you will have the optimum possible profit percentage in relation to the percentage of risk exposure.

Related Templates:

- Price List Template

- Pivot Point Calculator Excel

- Average Selling Price

- Product Price List

- Option Pricing

View this offer while you wait!